EFG Hermes Holding achieved major milestones on a Group-wide scale, delivering outstanding financial and operational results across its core operations and lines of business and creating meaningful impact across its geographical footprint

Despite the global headwinds witnessed in 2022, I reflect on the year with nothing but immense pride. EFG Hermes Holding achieved major milestones on a Group-wide scale, delivering outstanding financial and operational results across its core operations and lines of business and creating meaningful impact across its geographical footprint — a testament to the relentless efforts of our teams and the effectiveness of our adapted strategies.

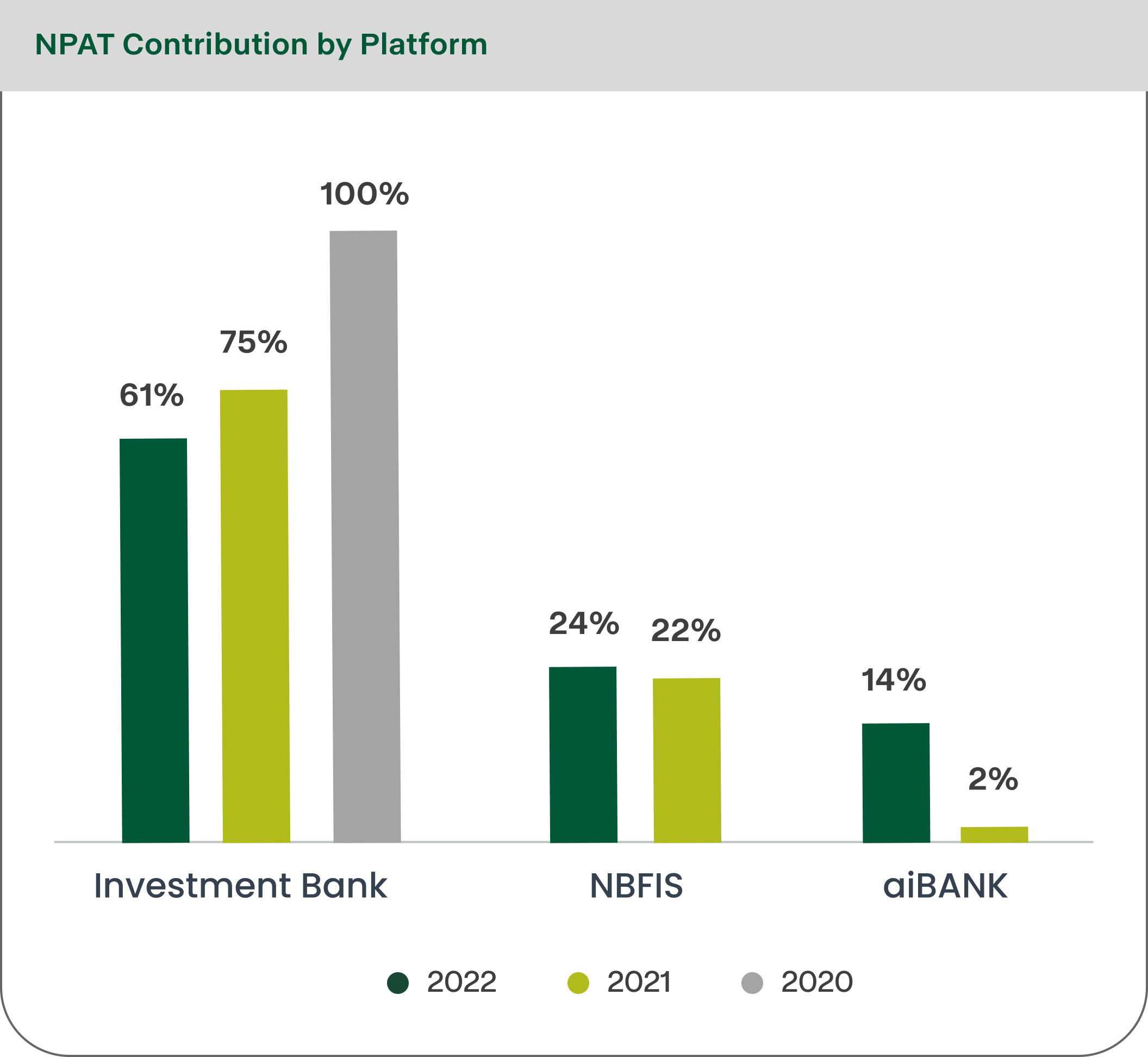

Following our acquisition of aiBANK in 2021, EFG Hermes Holding transformed into a universal bank in Egypt and a provider of a full spectrum of bespoke financial services. During 2022, we continued to see the Group’s verticals — the leading investment bank franchise, the non-bank financial institutions (NBFI) platform, and the commercial bank — demonstrate resilience and stability amid global macroeconomic volatility and come together to offer synergistic, value-add offerings that had the power to transform individual lives, grow businesses, and enact wider economic and market change throughout our footprint. 2022 saw a multitude of cross-selling partnerships between our different products, our lines of business, and our teams, with an eye toward providing our clients with access to end-to-end finance and investment prospects across the markets in which we operate — proof positive of how synergies are and will remain the focal point of EFG Hermes Holding’s business model.

The investment bank continues to outperform across its operational footprint. On the sell side of the business, the Investment Banking division continued to advise on the largest, most prominent ECM, DCM, and M&A transactions in 2022, particularly in the GCC as the region witnessed favorable investor sentiment following the surge in oil prices witnessed during the year. The division advised on a multitude of landmark transactions in the GCC, including Americana International Restaurants’ dual listing between the Abu Dhabi Securities Exchange (ADX) and the Saudi Exchange, Taaleem’s IPO on the DFM, Riyadh Cables’ IPO on the Saudi Exchange, and Borouge plc’s IPO on the ADX, among others. I am also happy to say that the division expanded its capacities to Kuwait, advising on Ali Alghanim and Sons Automotive Company’s private placement ahead of its IPO on Boursa Kuwait, marking the first IPO on the Kuwaiti exchange since 2020. These transactions perfectly align with our strategy to bring to market quality investment prospects that are strategic and value-accretive for local and global investors alike. Similarly, the Brokerage division continues to drive growth for the Group, sustaining its leading positions across its markets of operations. In 2022, the division successfully ranked first on the Egyptian Exchange (EGX) and the Dubai Financial Market (DFM) and second in Abu Dhabi and in Kuwait. On the buy side of the business, the Private Equity division continues to drive investments in the renewable energy, healthcare, and education sectors, sustaining its position as a long-term impact investor across key industries. Building on its successful acquisition of Spain-based Ignis Energy Holdings in 2021, our renewables-focused platform Vortex Energy continued to ramp up its investments in Ignis, helping the integrated renewables player boost its capacities and capture a large share of demand for alternative energy solutions in the European region. As we gear up for 2023, Vortex Energy looks to venture into more fields, including energy storage and electrical vehicle (EV) charging, as it continues to lay the foundation for the transition toward clean energy and a net-zero future.

I am also pleased with the exceptional performance of our flagship NBFI platform, which continues to unlock access to finance through its comprehensive suite of offerings, including consumer financing through valU, microfinance through Tanmeyah, leasing and factoring through EFG Hermes Corp-Solutions, insurance through Kaf, e-payments through PayTabsEgypt, and mortgage finance through Bedaya. 2022 saw the various entities under our NBFI umbrella come together seamlessly to help Egyptians of all income levels build the lives they want to live and alleviate their financial burdens, in addition to helping businesses of all sizes deliver on their growth and expansion plans.

Our third vertical, the commercial bank, continues to play a pivotal role in providing retail banking services to individual clients and corporate debt services to a wide range of institutional clients. During 2022, aiBANK was successful in providing financing for clients of both valU and used vehicles marketplace Sylndr, in addition to acting as the lender on EFG Hermes Corp-Solutions’ debt arrangement for MARAKEZ, as part of the latter’s financing package for its flagship Mall of Arabia. Going forward, I am confident that our acquisition of aiBANK will unlock more synergistic prospects across the Group.

While I am very proud of the tremendous success witnessed across the Group’s operational footprint this year, I am equally proud of our ability to uphold our commitment and responsibility toward the sustainable development of the community in which we live and work, as we continue to contribute to the improvement of Egypt’s underserved governorates. In 2022 alone, the EFG Hermes Foundation signed an MoU with the Ministry of Social Solidarity to take part in the Haya Karima initiative, a presidential initiative that aims to alleviate burdens on citizens in rural communities and urban slums, enhancing their quality of life through a set of initiatives that cover services, development, and production activities. Through this MoU, we have collaboratively begun rehabilitating 26 houses in the area of Al-Deir, Esna, in the Luxor governorate. Additionally, the Group came together with aiBANK to sponsor and support the National Initiative for Green Smart Projects in Egypt — a program that fell in line with the principles that were presented at COP27 — in efforts to achieve sustainable development as part of Egypt’s Vision 2030. The Foundation also partnered with the Ministry of Education and Technical Education to transition over 100 Schools in Luxor and Aswan to clean solar energy. These accomplishments are a culmination of our efforts to create deep impact across our community, underscoring the importance of responsible financing and how much we value ESG frameworks within our organization.

Going into 2023, and while global market conditions remain difficult, I am confident in our ability to continue withstanding and rising above the challenges that come our way. It is our agility that enables us to effectively combat volatility and persevere even during the most testing times. We will continue capitalizing on our track record and the unparalleled capabilities of our teams to sustain our ironclad position as the leading financial services institution in Frontier and Emerging Markets (FEM), continuously providing the market with the most compelling opportunities that create value across the board.

In closing, I would like to take the opportunity to thank our esteemed Board of Directors, whose term comes to an end this year, for yet another remarkable year of service. The Board has been at the helm of EFG Hermes Holding’s success in 2022 and an invaluable asset providing continuous guidance and support as we navigated through a turbulent macroeconomic environment. Over the years, EFG Hermes Holding has gone from strength to strength, growing its portfolio to complement its bespoke offering in the market and breaking ground in new markets — all of which would not have been possible without the efforts and diversified expertise of its board members. I would also like to thank our senior management and our teams for their continuous efforts and tremendous work this year. It is our people who have helped shape EFG Hermes Holding into what it is today, and I could not be prouder to be working alongside the individuals who have single-handedly grown the business into what it is today — an impact-driven institution that continues to raise the bar in the financial services industry for people from all walks of life and businesses of all sizes.

Despite the challenges, we ended the year with a solid set of results and reported successes across numerous metrics backed by prudent balance sheet management and the solid operational performance of many of our divisions

2022 was a year rife with external challenges for us as a Firm and the world over. The easing of pandemic-related constraints, the Russia-Ukraine war, inflationary pressures, and subsequent monetary tightening were just some of the factors shaping the global macro environment and, in turn, impacting the geographies in which we operate. While GCC jurisdictions benefited from a high oil cycle and a boom in economic activity, our offices in non-oil-producing countries were less immune to the unfavorable global environment. Despite the challenges, we ended the year with a solid set of results and reported successes across numerous metrics backed by prudent balance sheet management and the solid operational performance of many of our divisions.

In saying this, we must consistently look inwardly at the work we still must do on all fronts to meet the expectations of our stakeholders. As we brace for the challenges ahead with the knowhow of the year that just ended un- der our belts, we’re entering 2023 with a more dynamic approach that will allow us to adapt to externalities while remaining committed to a vision and execution strategy guided by our 6Ps: People, Positioning, Presence, Products, Profitability, and Public Responsibility.

Key to this will be supporting expansions that yield long- term results while, at the same time, optimizing our service portfolio to conserve capital and lean out expenses to increase our efficiency metrics. Although we will not be expanding our physical Presence in the year ahead, we will continue to focus on growing our positioning and businesses outside Egypt. We remain extremely bullish on growth prospects in the GCC and will focus further on our three key markets of the UAE, Saudi Arabia, and Kuwait as we diversify our revenue base in 2023. In Egypt, cross-selling will become the theme for 2023 as we serve our corporate and retail client base with a growing Product suite that includes commercial banking, BNPL services, leasing, advisory, and brokerage, among others. This increased cross-selling should also improve our Profitability — the lynchpin of our performance metrics considering the trickle-down impact on our entire stakeholder base.

At the same time, making returns without compromising our commitment to the people and communities we do business in is a core value we have long held. Public Responsibility, which encompasses a strong commitment to environmental, social, and governance (ESG) best practices, is not a pillar we use to enhance our image to stakeholders but the driving force behind everything we do. As such, 2023 will also see us further integrate ESG performance metrics and mitigation strategies into all our businesses.

Finally, and most importantly, People will continue to be the most important pillar of our success. Inflation and, in some jurisdictions, extenuating circumstances like natural disasters have made this a challenging year for our EFG Hermes Holding family. As such, supporting our best and brightest by ensuring they are rewarded for the value they bring to the company, are given clear growth paths, and learning and development opportunities will remain a top priority as we maintain our position as an undisputed employer of choice for our people.

While the road ahead remains unclear, we are steadfast in our belief that a healthy balance sheet, a diverse business model, and an employee base that continues to include some of the brightest and most dedicated in the business will carry us through. I want to take this opportunity to thank our esteemed Board of Directors for their stalwart guidance throughout the year just ended, our management teams across the region for their measured and strategic leadership, as well as the people serving and advising our clients, developing innovative products and solutions, and making sure the Firm runs with ease and efficiency. Only by having a shared understanding of what we want to build for the future and a collective commitment to seeing it through can we weather the events of tomorrow — whatever they may be — to ensure we maintain our Positioning as the region’s largest and most innovative financial services corporation.

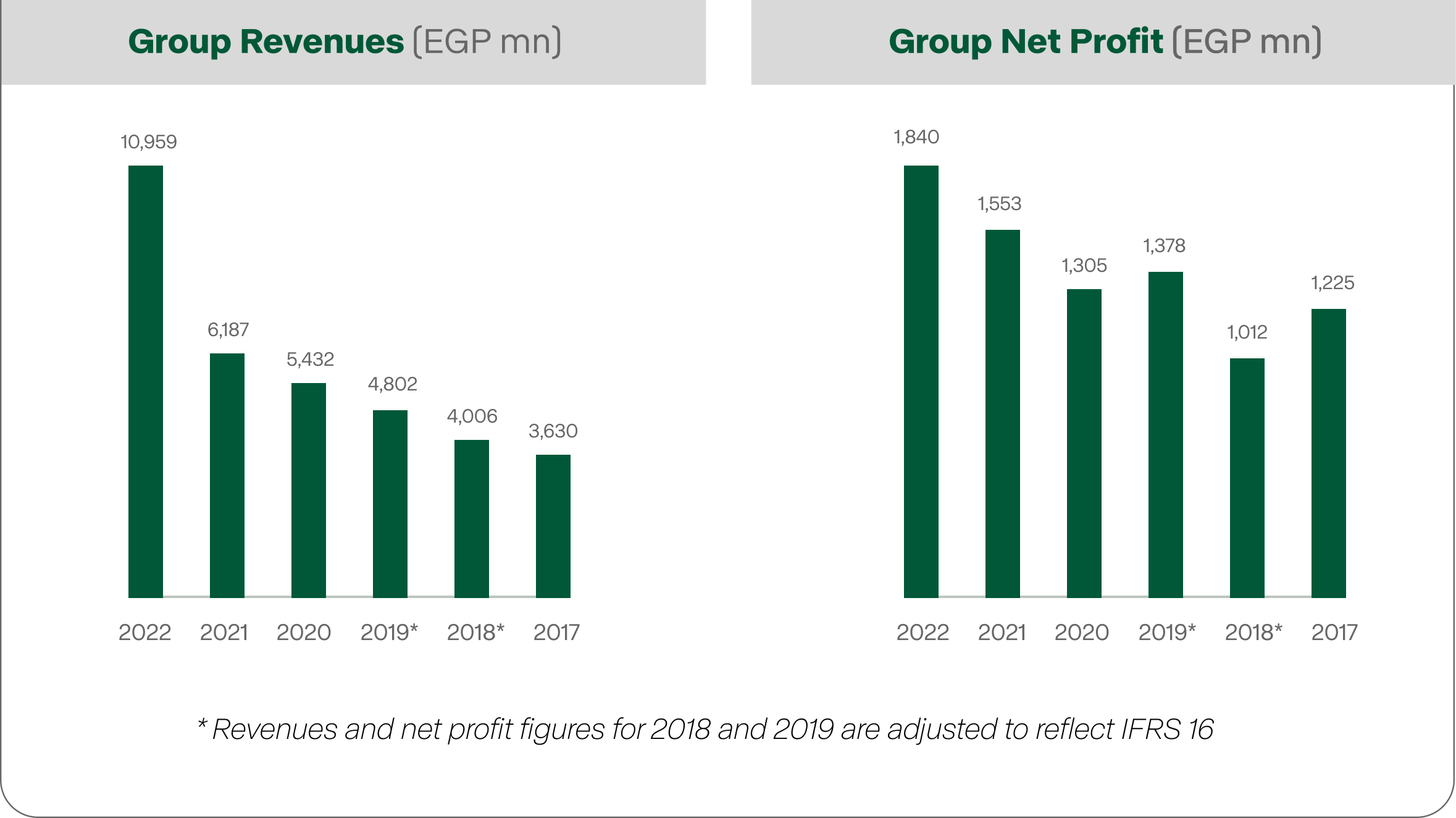

EFG Hermes Holding recorded double-digit growth across its top and bottom lines in 2022, pri-marily driven by the remarkable performance across its three operational verticals, the Investment Bank, the Non-Bank Financial Institutions (NBFI) platform, and the Commercial Bank.

Overview

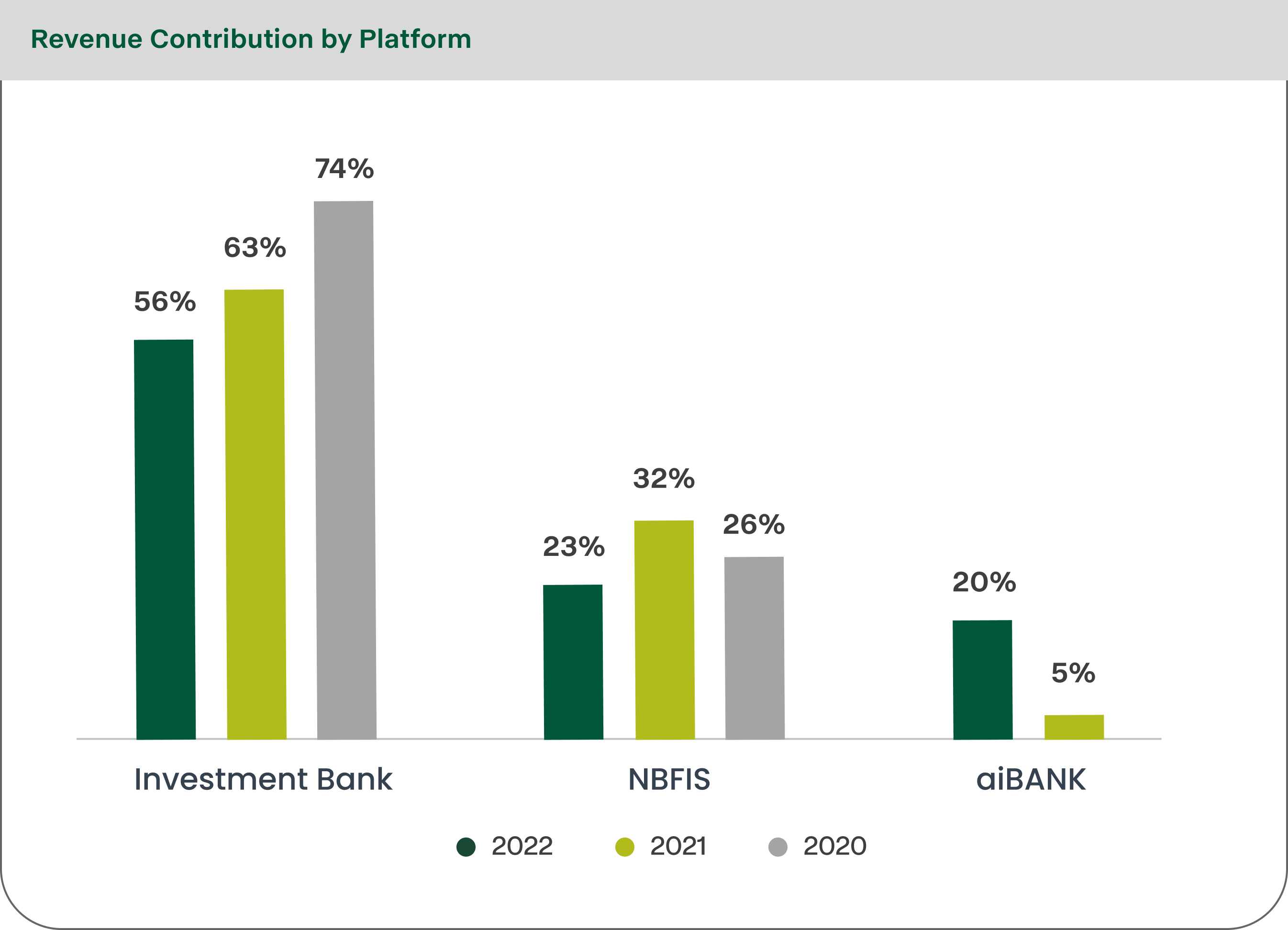

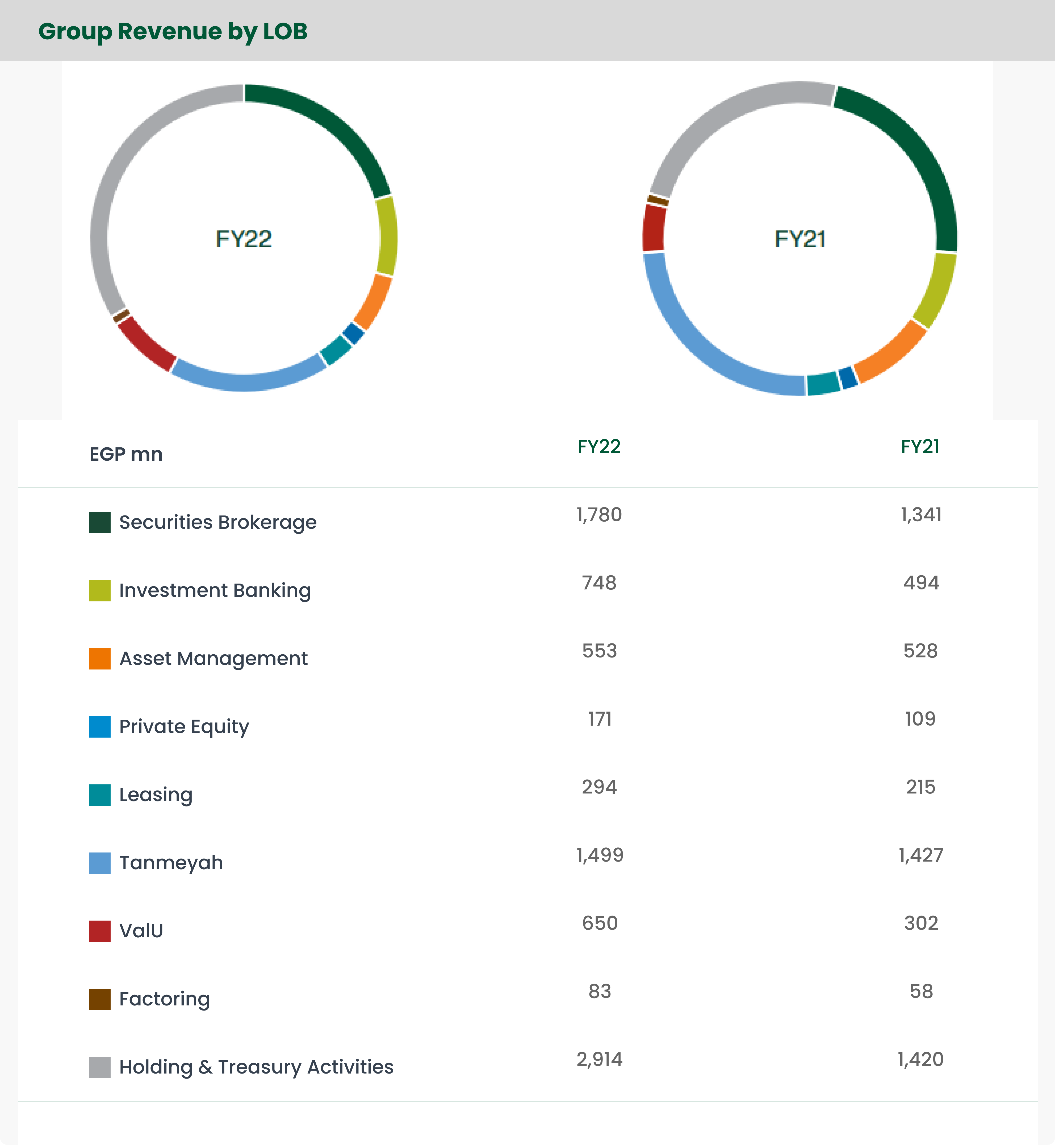

Notwithstanding the macroeconomic headwinds witnessed in 2022, EFG Hermes Holding achieved strong growth during the year, recording operating revenues of EGP 11 billion — a substantial increase of 77% Y-o-Y from the EGP 6.2 billion booked in the previous year, which was primarily driven by the solid performance delivered across the Group’s three verticals.

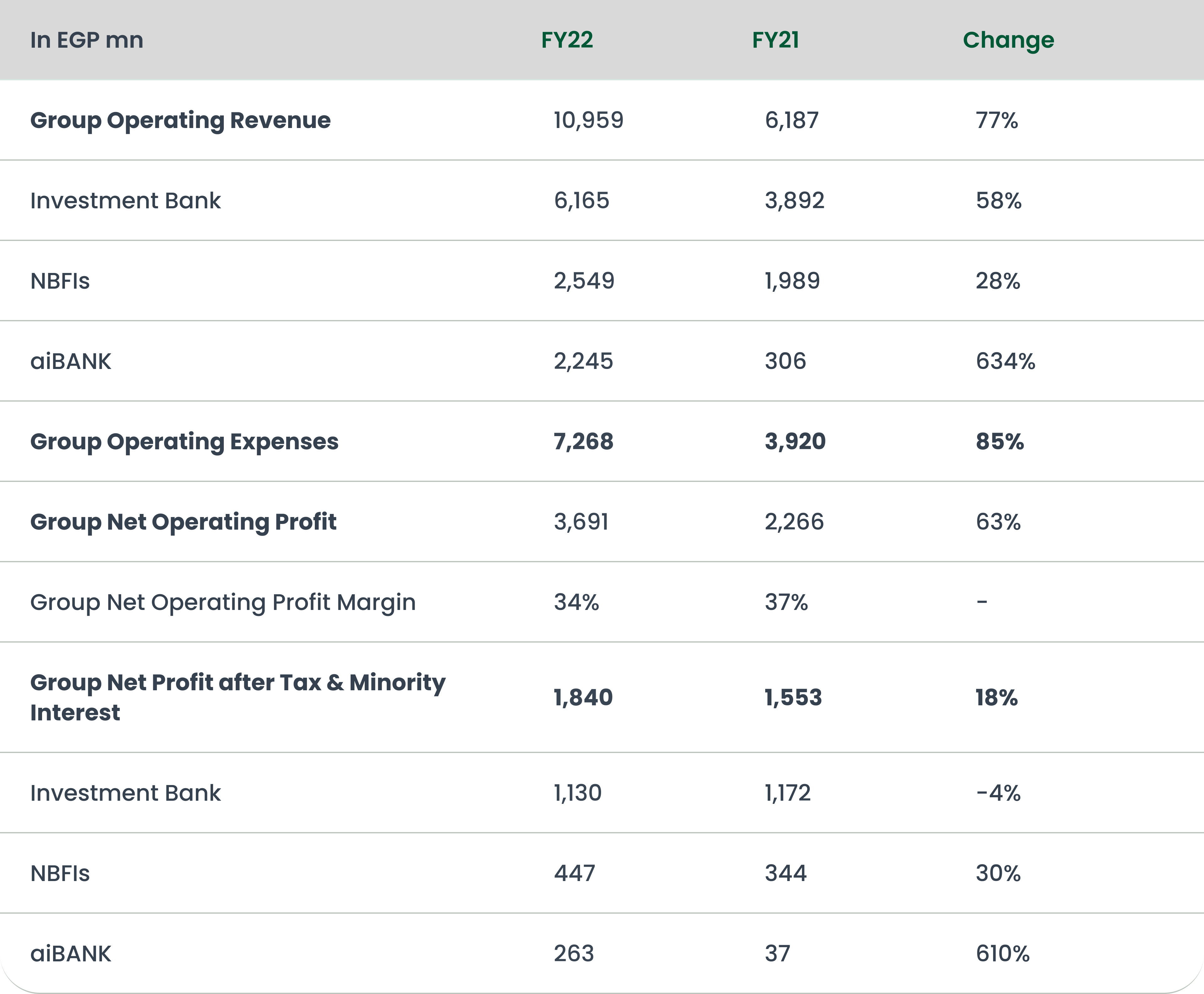

EFG Hermes, the leading Investment Bank franchise in Frontier and Emerging Markets (FEM), recorded revenues of EGP 6.2 billion at year-end 2022, reflecting a Y-o-Y increase of 58% and representing 56% of the Group’s consolidated top line, mainly on the back of the strong performance of the vertical’s sell-side business, which witnessed a 38% growth Y-o-Y to stand at EGP 2.5 billion. The Firm’s Investment Banking division continued to leverage its unrivaled placement and execution capacities to advise on the region’s most prominent and compelling equity, debt, and M&A transactions. As a result of its immense efforts, and having advised on a total of 32 transactions worth an aggregate of USD 14.3 billion, the division registered revenues of EGP 748 million, reflecting an increase of 51% Y-o-Y. On the buy-side, the business recorded revenues amounting to EGP 723 million, reflecting a Y-o-Y increase of 14%.

The NBFI platform, which represented 23% of the Group’s total top line, reported revenues of EGP 2.5 billion, reflecting a Y-o-Y growth of 28%, on the back of the strong performance delivered across the platform’s subsidiaries, particularly the twofold increase in revenues reported by valU, the MENA region’s leading lifestyle-enabling fintech platform.

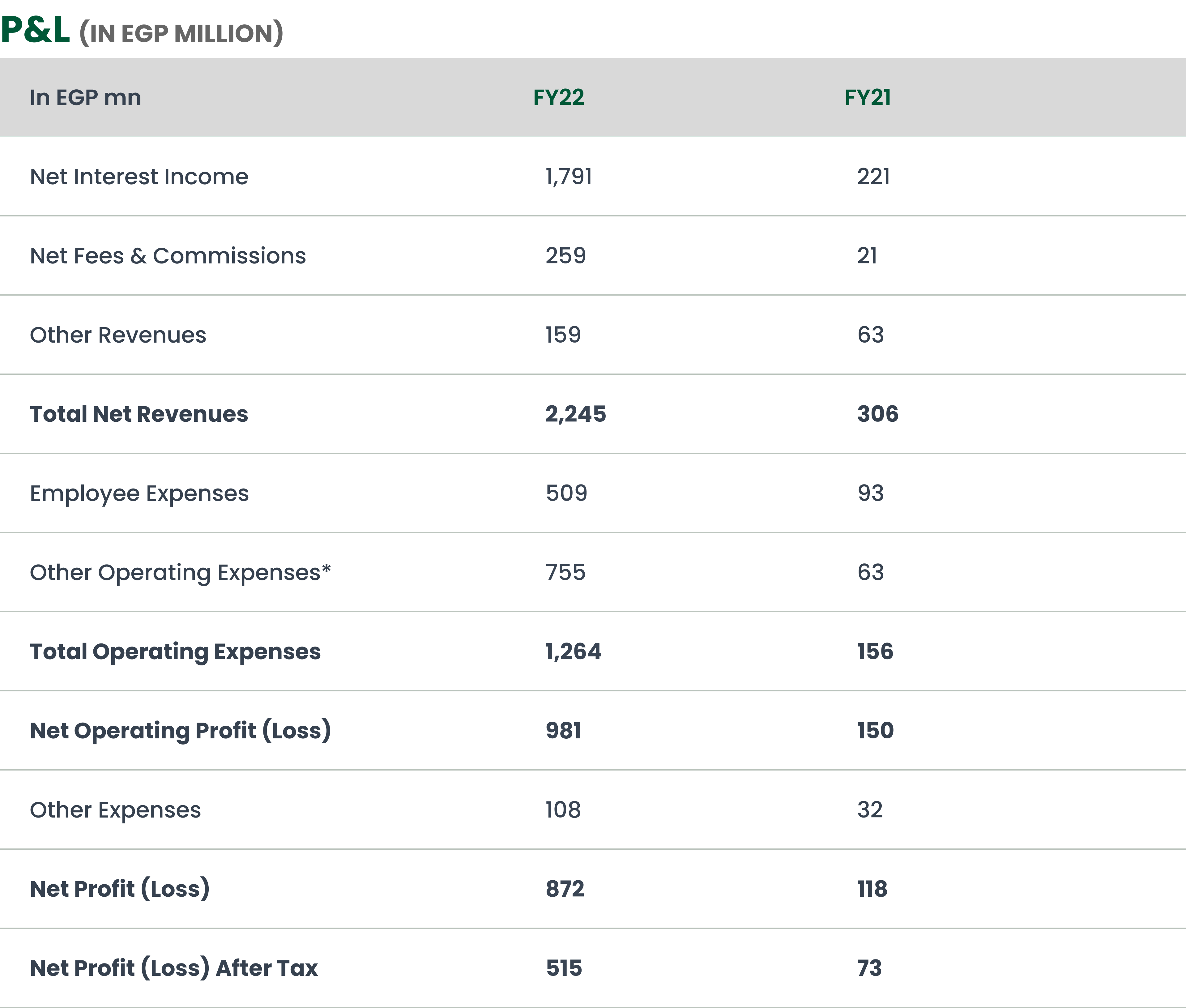

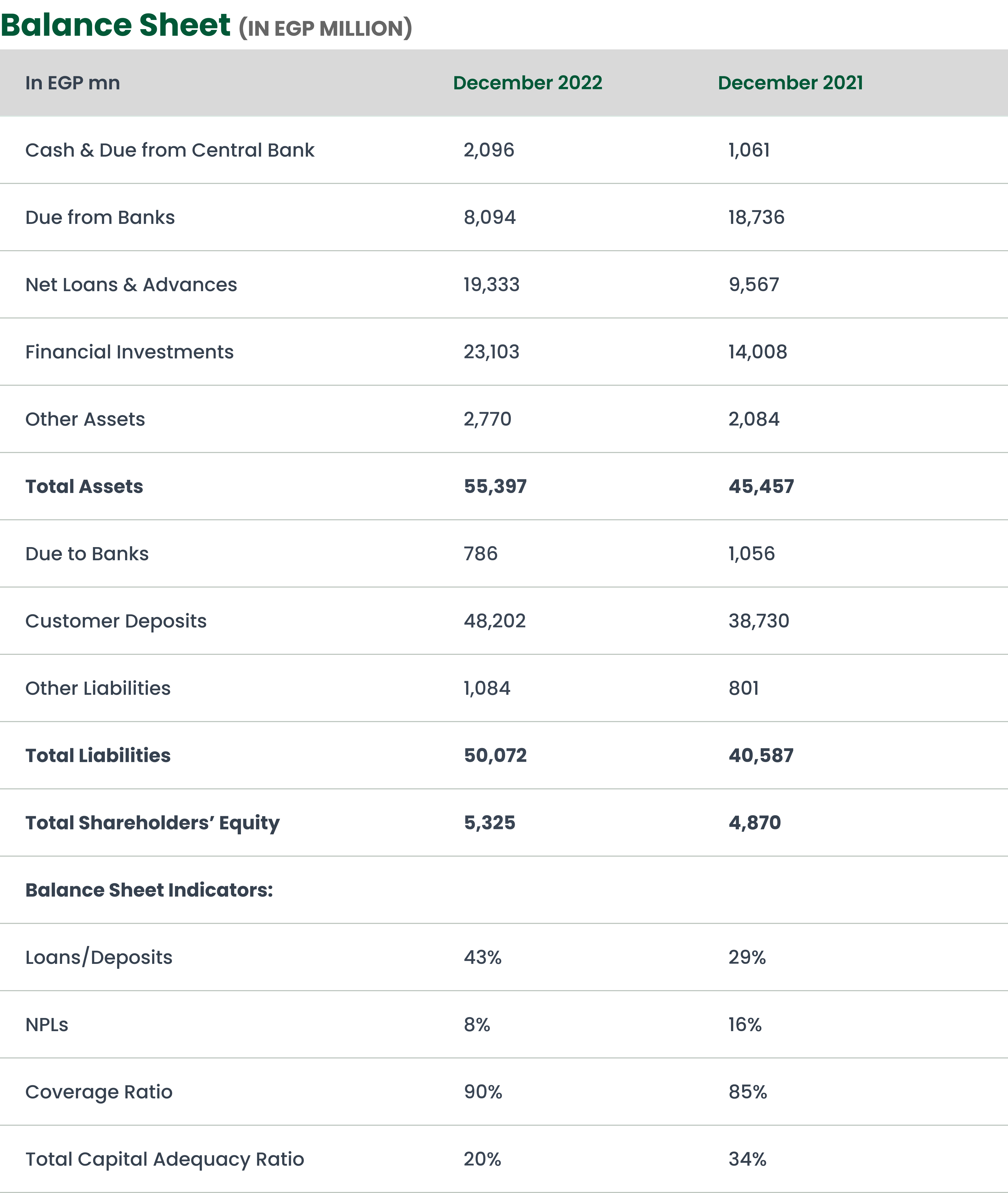

The Group’s commercial bank, aiBANK, which contributed an impressive 20% to the Group’s total top line, recorded revenues of EGP 2.2 billion and a net profit after tax (NPAT) of EGP 515 million. This was driven by the substantial increase in net fees and commissions on the back of the bank’s growth in trade finance transactions and an accelerated increase in the booking of retail loans.

EFG Hermes Holding’s operating expenses increased by 85% Y-o-Y in 2022 to reach EGP 7.3 billion due to rising inflationary pressures, the USD-denominated expenses incurred across the Group’s regional offices, higher salaries, and the substantial growth of the Group’s business operations and subsidiaries during the year, particularly valU, which saw significant improvement across its operations and portfolio.

EFG Hermes Holding’s net profit after tax and minority interest came in at EGP 1.8 billion — an 18% Y-o-Y increase from the previous year, which was relatively subdued by higher taxes, mainly incurred by aiBANK, in addition to the deferred tax of EGP 399 million on unrealized gains on in- vestments and seed capital and foreign exchange gains on the Investment Bank’s side.

Group Financial Highlights

Overview

6.2EGPBN

Securities Brokerage

In 2022, EFG Hermes' Securities Brokerage division concluded executions worth USD 96.3 billion, reflecting an increase of 36% Y-o-Y, driven by the rise in MENA market executions, particularly in Saudi Arabia, Qatar, and the UAE. The division booked revenues amounting to EGP 1.8 billion by the end of 2022, reflecting an increase of 33% Y-o-Y from the revenues registered in the prior year, mainly driven by the stronger revenues generated from the UAE, Saudi Arabia, Kuwait, Egypt, and Qatar.

Regarding contribution to pure brokerage commissions, Egypt and the UAE markets (Dubai and Abu Dhabi) shared the first place with a contribution of 19% each, followed by Saudi Arabia and Kuwait with a 16% contribution each. Qatar followed with a contribution of 13%, and frontier markets, including Nigeria, Kenya, Pakistan, and other frontier execu-tions, came in fourth with a 6.5% contribution.

As a result of its solid performance during the year, EFG Hermes was successful in sustaining its leading position as the broker of choice across its footprint, having maintained its first-place ranking on the EGX, with a market share of 40.2%. Additionally, in its home market of Egypt, the Firm successfully retained 78% of the 25.8% foreign participation for the year. In the UAE, EFG Hermes maintained its first-place ranking on the DFM, with a market share of 41.1% in 2022 and successfully captured 43% of inflows from the 40% foreign participation in the market. In Abu Dhabi, the Firm fortified its second-place ranking on the ADX, with a market share of 14.7%, capturing 32% of the 18% of foreign flows in the market. In Saudi Arabia, EFG Hermes was sixth among pure brokers (non-commercial banks), with a 4.4% market share in 2022. In Kuwait, the Firm ranked second on Boursa Kuwait, with a market share of 32.8% at year-end 2022. In Oman, the Firm ranked fifth, with a market share of 17.3%. In Jordan, the Firm ranked 12th in 2022, with a market share of 6.3%, and captured 24% of the 3% in foreign activity witnessed in the market.

In frontier markets, the Pakistani market index declined by 9.4% Y-o-Y and volumes decreased by 58% Y-o-Y. The foreign activity also continued to drop, at 7% of total market turnover in 2022, of which the Firm successfully captured 12%. By the end of the year, the Firm had recorded a market share of 3.7% in Pakistan. In Kenya, the Firm sustained its first-place ranking for the third consecutive year, recording a market share of 70.0% in 2022, which was primarily driven by the increase in foreign executions during the year. In Nigeria, the Firm placed fifth in 2022, with a market share of 9.9%.

Research

During 2022, EFG Hermes’ award-winning Research division continued to leverage its unrivaled in-house capabilities to provide the most comprehensive and impactful FEM research to clients around the world, initiating coverage on 22 new small- to mid-cap and large-cap stocks, with 12 of these initiations being UAE-based companies given the substantial pipeline of prominent IPOs, and the increased traction garnered across UAE markets. By the end of the year, the Research division had recorded a total coverage of 338 stocks in 25 countries across MENA and frontier markets.

n 2023, the division aims to deepen its MENA-based re-search while adding new countries to its Asian coverage, particularly in the first quarter of the year and driven by the strong growth potential in the region.

Investment Banking

EFG Hermes’ Investment Banking division has cemented its leading position as the regional investment bank of choice for partners and clientele in the MENA region and FEM. Leveraging decades of industry and market acumen, and backed by 43 industry experts, the flagship division continues to advise on the region’s largest, most prominent transactions in the M&A, ECM, and DCM spaces.

By the end of 2022, the division had concluded advisory on 32 ECM, DCM, and M&A transactions across its footprint, with an aggregate value of over USD 14.3 billion, and recorded revenues of EGP 748 million, reflecting an increase of 51% Y-o-Y from the EGP 494 million recorded in the previous year.

On the equity front, EFG Hermes' Investment Banking di-vision continued to dominate the region, having advised on the GCC region’s most notable IPOs, including leading education provider Taaleem’s USD 204 million IPO on the Dubai Financial Market (DFM), marking the first private sector IPO on Dubai’s stock exchange since 2014. The division also concluded advisory on state-owned Dubai Electricity and Water Authority’s (DEWA) USD 6.1 billion IPO on the DFM — the largest-ever listing in the Middle East since Saudi Aramco’s record share sale in 2019 and a first-of-its-kind transaction for a public company in Dubai. In Kuwait, EFG Hermes advised on the USD 323 million private placement for Ali Alghanim and Sons Automotive Company ahead of its IPO on Boursa Kuwait, marking the first IPO in the Kuwaiti stock market since 2020, and the largest in the country. In Saudi Arabia, EFG Hermes advised on the USD 400 million IPO for cable manufacturer Riyadh Cables (RCGC) on the Saudi Exchange. In Oman, the division concluded advisory on the USD 60.6 million IPO of Pearl REIF — Oman’s largest Shariah-compliant real estate investment fund — on the Muscat Stock Exchange (MSX). 2022 also saw the division advise on the USD 1.8 billion IPO of Americana Restaurants International Plc (Americana) on the Saudi Stock Exchange and the ADX, marking the first-of-its-kind concurrent dual listing between the two exchanges.

On the M&A front, the division acted as sell-side advisor on the USD 500 million majority stake sale of Al Meswak Dental Clinics, the largest dental and dermatology ser-vice provider in Saudi Arabia. In Egypt, EFG Hermes' Investment Banking division acted as sell-side advisor on the acquisition of a 70% stake in two Egypt-based maritime and terminal operating companies, Transmar International Shipping Company (Transmar) and Trans-cargo International (TCI), by Abu Dhabi Ports Group (AD Ports). The transaction, valued at USD 140 million, marked AD Ports’ first investment in Egypt. The team also acted as buy-side advisor to the Public Investment Fund of Saudi Arabia (PIF) on its indirect acquisition of a significant minority stake valued at USD 126.7 million in B.Tech, Egypt’s leading consumer electronics retailer. Other landmark deals for the year included the sell-side advisory on the USD 115.7 million majority acquisition of Auf Group, a leading healthy snacks and coffee manufacturer and retailer in Egypt, by UAE-based Agthia, a leading food and beverage company in the region.

In the DCM space, the team concluded advisory on several securitization deals for the Firm’s subsidiaries, including EFG Hermes Corp-Solutions on the second issuance of its securitization program, in a transaction worth USD 102.3 million, marking the team’s largest debt transaction in 2022. Another transaction was that of Bedaya Mortgage Finance (Bedaya), which saw the division advise on the mortgage finance player’s first securitization issuance worth EGP 651.2 million. Additionally, the team advised real estate player Orascom Development Egypt on the USD 81.0 million financing package for its flagship project, O-West. Parallel to this, the team advised MARAKEZ, a leading Saudi real estate player in Egypt, on its USD 39.2 million debt arrangement alongside EFG Hermes Corp-Solutions and the Firm’s commercial bank, aiBANK, who acted as leasing partner and lender, respectively. As part of its strategy to bring a broader range of offerings to market, the Investment Banking division concluded advisory on CIRA Education’s EGP 800 million future flow securitization bond offering — Egypt’s first-ever future flow securitization issuance.

Asset Management

In 2022, the Group’s Asset Management division recorded revenues amounting to EGP 553 million, reflecting an increase of 5% Y-o-Y from the EGP 528 million recorded at year-end 2021. EFG Hermes’ Asset Management operations in Egypt registered a 10% Y-o-Y growth in AUM, driven by the favorable performance of equity markets during the year, coupled with rising net inflows in money market funds (MMFs). Regional AUM from the Firm’s regional arm, Frontier Investment Management (FIM) Partners, also grew in 2022 to record USD 2.7 billion, up 5.2% Y-o-Y from the USD 2.6 billion booked one year previously, as the division delivered a solid performance across its funds and managed accounts, in addition to the growth in net inflows from equity portfolios. Additionally, FIM was successful in onboarding a new key account during the year as a cornerstone of its strategy to broaden its investor network.

During the year, the Asset Management division established a new office in Muscat, Oman, to expand its regional presence.

Private Equity

EFG Hermes’ Private Equity division focuses on driving value-accretive investments in strategic and impactful sectors. As such, the division invests in businesses operating in key industries — including renewable energy, education, and healthcare — that generate lucrative financial returns and social and environmental impacts. In 2022, the division registered revenues amounting to EGP 171 million, indicating a climb of 57% Y-o-Y.

On the renewables front, the division manages investments through its dedicated Europe-focused platform, Vortex Energy. In 2022, Vortex Energy invested its second tranche into Ignis Energy Holdings, bringing total investments to EUR 300 million and highlighting the strategic importance of its long-standing relationship with the company. The injections came as part of the plan to have Vortex Energy invest EUR 476 million into the Spanish renewables player through its recently launched fund Vortex Energy IV. Through this, Vortex Energy continues to help Ignis boost capacities, transforming into a fully integrated renewable independent power producer (IPP) in Spain and other geographies.

The Firm’s education platform, Egypt Education Platform (EEP), continues to cement its position as the region’s largest performing education-focused platform, broadening its capacities in Egypt’s education sector and diversifying its investment portfolio of leading international schools. Following the addition of Al Hayah International Academy to the platform in 2021, the EEP acquired Hayah West in Sheikh Za-yed in 2022. The EEP also concluded new acquisitions during the year, including flagship GEMS International School in Cairo (GISC), Trillium the Montessori house — the latter marking the platform’s first break into the burgeoning pre-K segment — and Egypt’s leading education content developer, Selah El Telmeez (SET). Currently, the platform owns and manages 19 schools and pre-schools under various stages of development, with a combined capacity of approximately 21,000 students and over 11,000 enrolled students.

In the healthcare space, the Firm’s healthcare-focused platform, Rx Healthcare Management (RxHM), delivered strong operational and financial results in 2022 as it continued to bolster its production capacities through United Pharma. United Pharma recorded a significant 85% increase in revenues at the end of the year and is well on track to achieve its 2023 targets. Parallel to the success of United Pharma, the Rx Healthcare platform continues to capitalize on lucrative prospects in the injectables and other generic pharma segments.

Non-Bank Financial Institutions

Tanmeyah

Tanmeyah, the Firm’s microfinance arm, achieved size-able growth across all performance metrics in 2022, particularly in terms of productivity and efficiency. By the end of the year, Tanmeyah recorded a superior portfolio value of EGP 4.3 billion, reflecting a Y-o-Y increase of 18% from EGP 3.7 billion at year-end 2021. The company also hit a total client base of 379,000 active borrowers, mainly due to writing-off clients worth EGP 116 million.

Tanmeyah’s total number of loans issued amounted to 371,000 by the end of the year, compared to 367,000 loans booked in 2021, with the company issuing loans worth around EGP 28 million daily, compared to the EGP 18 million allocated last year. While the number of loans issued remained relatively flat during the year, Tanmeyah focused on increasing ticket sizes, with its MEL average ticket size rising by 32% Y-o-Y to record EGP 1.97 thousand.

By year-end 2022, Tanmeyah’s revenues stood at EGP 1.5 billion, edging up 5% Y-o-Y despite more robust sales on the back of a higher interest expense. Tanmeyah’s revenues included EGP 23 million attributed to Fatura, the company’s recently acquired retail marketplace platform.

Tanmeyah also successfully implemented its digital col-lection plan, which was initiated during the year to cover five of the company’s branches. Today, all of Tanmeyah’s 306 branches use digital collection platforms, with digital collections representing 35%, equivalent to EGP 599 million, of Tanmeyah’s 4Q22 collections, of which 63% came through Fawry, 21% through O-Pay, and 16% through Damen.

valU

2.5EGPBN

valU, MENA’s leading fintech, lifestyle-enabling platform, delivered an exceptional performance across all its metrics in 2022. By the end of the year, valU registered 568,000 app customers and over 1 million transactions completed through its app. With an average ticket size of EGP 5,000, valU concluded the year with a total gross merchandise value (GMV) of EGP 5.8 billion — a twofold increase from the EGP 2.4 billion booked in 2021. The fintech player’s revenues climbed by 115% Y-o-Y to EGP 650 million, underpinned by a significant Y-o-Y growth in loans issued and the value of its outstanding portfolio.

During the year, valU also acquired Paynas, a full-fledged employee management and benefits company that of-fers services to MSMEs in collaboration with Banque Misr and Visa. The acquisition perfectly positions valU to capture more opportunities and become a holistic lifestyle-enabling platform that serves the needs of multiple segments with progressive and convenient financial solutions.

Working with EFG Hermes Investment Banking, 2022 saw valU issue its second and third securitized bond offerings, worth EGP 532.6 million and EGP 854.5 million, respectively. Both issuances came as part of a broader EGP 2 billion program to support the company’s expansion plans.

EFG Hermes Corp-Solutions – Leasing

EFG Hermes Corp-Solutions’ leasing arm recorded a total value of bookings amounting to EGP 4.4 billion — an increase of 12% Y-o-Y from the EGP 3.9 billion recorded in 2021. As a result of its portfolio growth for the year and the gains generated from its second securitized bond offering worth EGP 2.0 billion, EFG Hermes Corp-Solutions’ leasing business recorded revenues amounting to EGP 294 million — an increase of 37% Y-o-Y from the EGP 215 million registered in 2021 and representing 12% of total NFBI top line.

During the year, the leasing arm forged a series of significant partnerships, including its signing of a USD 25 million deal with Transmar, a wholly owned subsidiary of IACC Holdings and Egypt’s only container shipping line, to finance the purchase of a cargo vessel, Transmar Legacy. The landmark transaction, which saw a collaboration between EFG Hermes Holding’s Investment Banking division and EFG Hermes Corp-Solutions, marked the leasing player’s strategic entry into the high- potential maritime sector.

EFG Hermes Corp-Solutions – Factoring

2022 was an exceptional year for EFG Hermes Corp-Solutions’ factoring business, which successfully grew its portfolio by 36%, recording a total value of bookings amounting to EGP 5.3 billion versus the EGP 4.2 billion booked one year previously. Factoring revenues for 2022 climbed by 43% Y-o-Y to EGP 83 million due to higher net interest income and fees and commissions.

aiBANK

aiBANK concluded 2022 having achieved growth across all its segments — Retail and Business Banking, SME and Midcap, Corporate Banking, and Islamic Banking — and registering an increase in newly banked customers during the year, coupled with organic growth from its existing customer base. The bank reported total net loans of EGP 19.3 billion in 2022, reflecting a 102% Y-o-Y increase from the EGP 9.6 billion recorded in 2021, and a net interest income of EGP 1.8 billion, reflecting an increase of 2022 saw EFG Hermes Corp-Solutions’ factoring arm extend its services to leading MENA logistics and transportation player TruKKer in a debt facility worth EGP 38 million. The partnership is slated to enable TruKKer to expand its operations in the Egypt branch by ramping up shipments and facilitating swifter payments. It also signed an agreement with oil and gas leader PICO Energy in a structured transaction worth USD 15 million, marking its entry into the oil and gas sector.

710% Y-o-Y from the EGP 221 million recorded at year-end 2021. The bank’s net commission income hiked by a strong 1,280% Y-o-Y to EGP 295 million, up from the EGP 21 million recorded in the previous year, driven by the increase in volumes of trade finance transactions and the accelerated bookings of retail loans. By the end of 2022, the bank recorded a net profit after tax (NPAT) of EGP 515 million.